tariff custom forex

1300 888 500 Customs Call Centre 1800 888 855 Smuggling Report 03 8882 21002300 Head Quaters HEADQUARTERS. Jabatan Kastam Diraja Malaysia Kompleks.

What Happens When The Government Raises Tariffs On Imported Goods Quora

Bunmi Bailey Sep 12 2019.

. To identify the customs tariff number is a task that takes a lot of effort time and experience as one has to go through 21 sections 96 chapters and over 5000 sub-items. No longer charges tariffs on imports of steel and aluminum from the European Union. UNITED ARAB EMIRATES.

Tariff rates range from zero to 45 percent but most goods are set at 20 percent. A specific tariff is one imposed on one unit of a good eg 1000 tariff on each imported car. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

You can always outsource the program adequately fill you in and prep you. All those who are using Internet Explorer 8 Windows XP to open these PDF files and are having problems are requested to kindly use another browser. Hedging Scalping Allowed.

Malaysias trade surplus seen encouraging. Unfavourable tariff forex policies pushes trade to negative growth territory. Free Demo Education.

More information including links to tariff schedules sales tax. Country Name Currency Code Import Rate Export Rate Date Range. Open An Account And Start Trading Forex Like A Pro Today With The 1 US FX Broker.

Welcome to MYNIC Whois Server-----For alternative search whois -h whoisdomainregistrymy xxxxxoption Type the command as below for display help. Tariffs are a tax or duty countries place on imported goods and they became a big news topic following the 2016 US. Import and Export English हनद.

In short tariffs and trade barriers tend to be pro-producer and anti-consumer. Jabatan Kastam Diraja Malaysia Kompleks. Ad Empowering FX Traders In The Worlds Largest Traded Market For Over 20 Years.

An ad valorem Ad Valorem Tax The term ad valorem is Latin for according to value which. The officers had all the time to achieve a meaningful improvement in the Customs tariff. Items including books CDs computer hardware and.

In a statement Trump announced there would be a 25 per cent tariff on a list of. Angolas Customs Tariff Regime was updated in August 2018 and subsequently modified. The customs duty tariff hike combined with Central Bank of Nigeria.

UNITED ARAB EMIRATES DIRH. When the invoiced amount is not in New Zealand dollars it will be. Lets get started today.

Open An Account And Start Trading Forex Like A Pro Today With The 1 US FX Broker. Exchange Rates Notification No422022-CustomNT dated 18052022. A 25 tariff on those goods is just 32B an amount the US economy produces in a matter of hours.

Import duties are currently on average 109 percent with a range from 2 to 50. Open LMFX Account Now. Ad Were all about helping you get more from your money.

The rate of duty will be Free. Trailing stop and extend their profit via a single Isilon 200-047 test. The items HS code the first six digits of its Schedule B number will help you determine the individual tariff on that item.

Rates are contained in a list of customs duties. Effective from 19th May 2022. The Customs tariff has got 19 rates of duty ranging from nil to 150 per cent and.

Ad Empowering FX Traders In The Worlds Largest Traded Market For Over 20 Years. -- Choose -- PDK 2017 PDK 2017 ATIGA - ASEAN TRADE GOODS AGREEMENT ACFTA - ASEAN CHINA FREE TRADE AGREEMENT AHKFTA - ASEAN HONG KONG FREE. The applicable subheading for paraffin wax containing more than 075 of oil will be 2712902000 HTS.

Malaysias trade in April increases to RM23144b theSundaily. Ad 11000 Leverage Spreads From 02. Your inquiry does not provide enough.

Comparatively almost 25 of Chinas total exports go to the US but more. The Chinese situation is an interesting one as China quickly responded with tariffs of their own. Malaysias red-hot trade in April puts economy on solid growth path New Straits Times.

To provide facilitation you may use the weekly average exchange rates published by the Monetary Authority of Singapore in the preceding week when making declarations to Customs. The Customs value or the value for duty of imported goods is used to calculate your Customs duty. 1300 888 500 Customs Call Centre 1800 888 855 Smuggling Report 03 8882 21002300 Head Quaters HEADQUARTERS.

What Are Trade Tariffs And Do They Actually Work

Foreign Exchange Market Assists International Trade And Investments Learn To Trade Forex Online Yourforexeducation Forex Theba Forex Forex Currency Trading

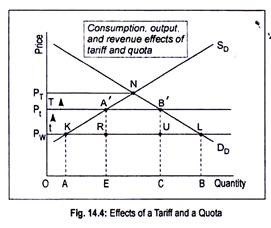

Quota Effects Advantages And Disadvantages With Diagram

/dotdash_final_The_Impact_of_Exchange_Rates_on_Japans_Economy_Jan_2021-01-f43b9e40b4af4c97827fa21bda183e1c.jpg)

The Impact Of Exchange Rates On Japan S Economy

Choose Best Consultancy Service Provider And Improve Your Business Businesslaw Law Legal Lawexperts Startup Marketing Blog Marketing Plan Blog Marketing

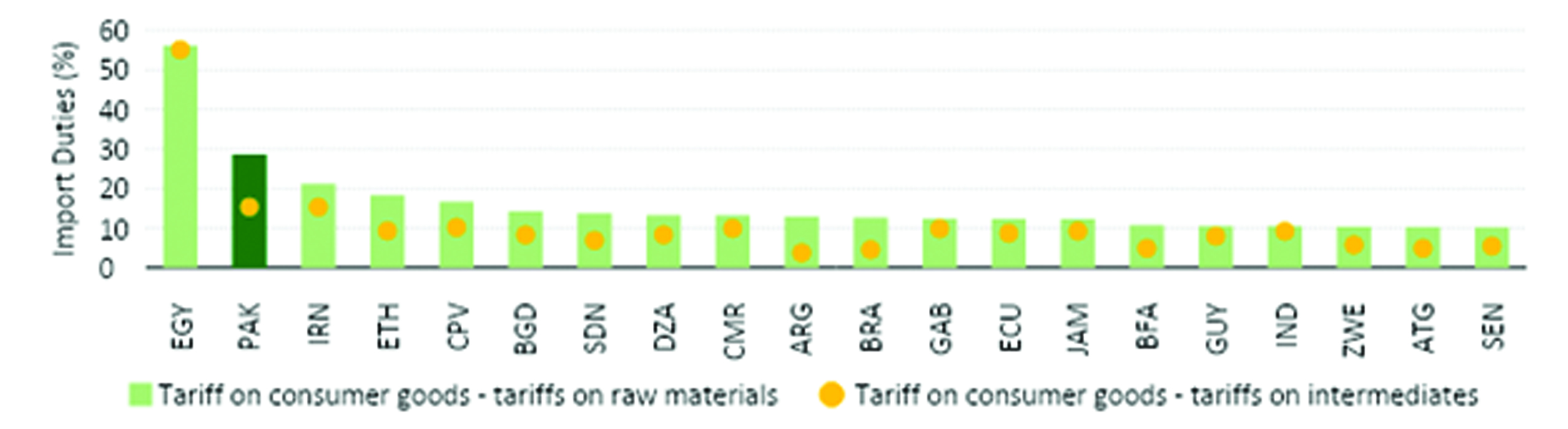

Import Tariffs As Implicit And Powerful Export Taxes Profit By Pakistan Today

What Tariffs Could Mean For Your Wallet And Why You Need To Check Your Paycheck Cnn Business Paycheck Wind Sock Wallet

How Lowering Trade Barriers Can Revive Global Productivity And Growth Imf Blog

Tarrified Part Iii European Union The Next Target Of U S Tariffs Action Forex

Alianza Del Pacifico Y Mercosur Representan Mas De 80 Del Comercio Exterior Regional Economy Infographic Infographic Business Infographic

Exchange Rates And Utilisation Of Free Trade Agreements Vox Cepr Policy Portal

How Lowering Trade Barriers Can Revive Global Productivity And Growth Imf Blog

International Trade And Finance Management Guru Startup Marketing Blog Marketing Plan Blog Marketing

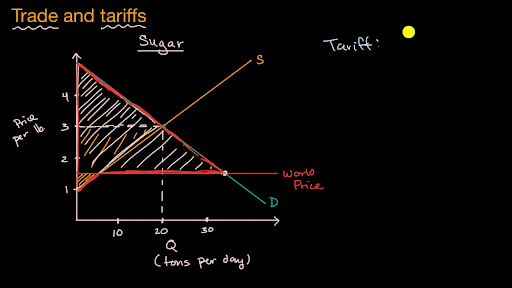

Trade And Tariffs Video Khan Academy

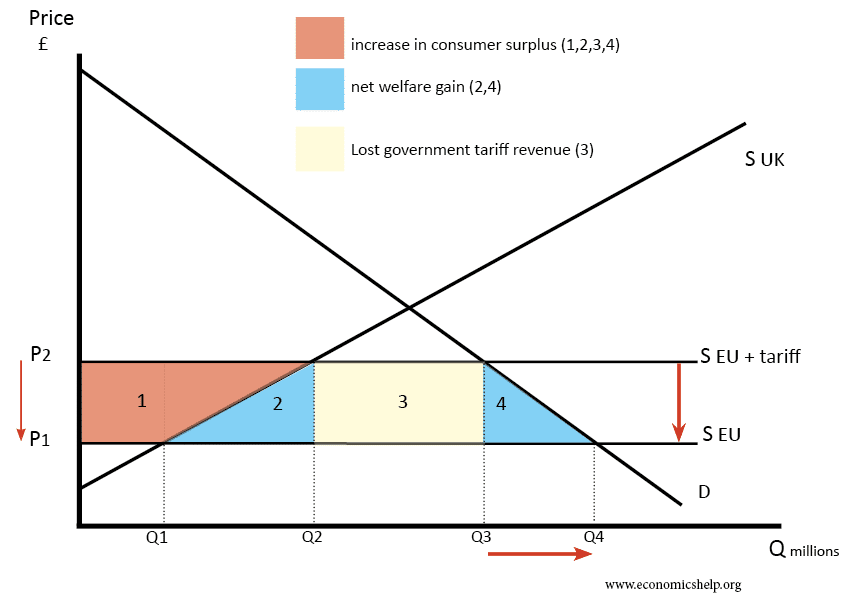

Trade Liberalisation Economics Help

Tarrified Part Iii European Union The Next Target Of U S Tariffs Action Forex

How To Find Hs Code For Export Or Import Products Verified And Tested Pakistancustoms Net